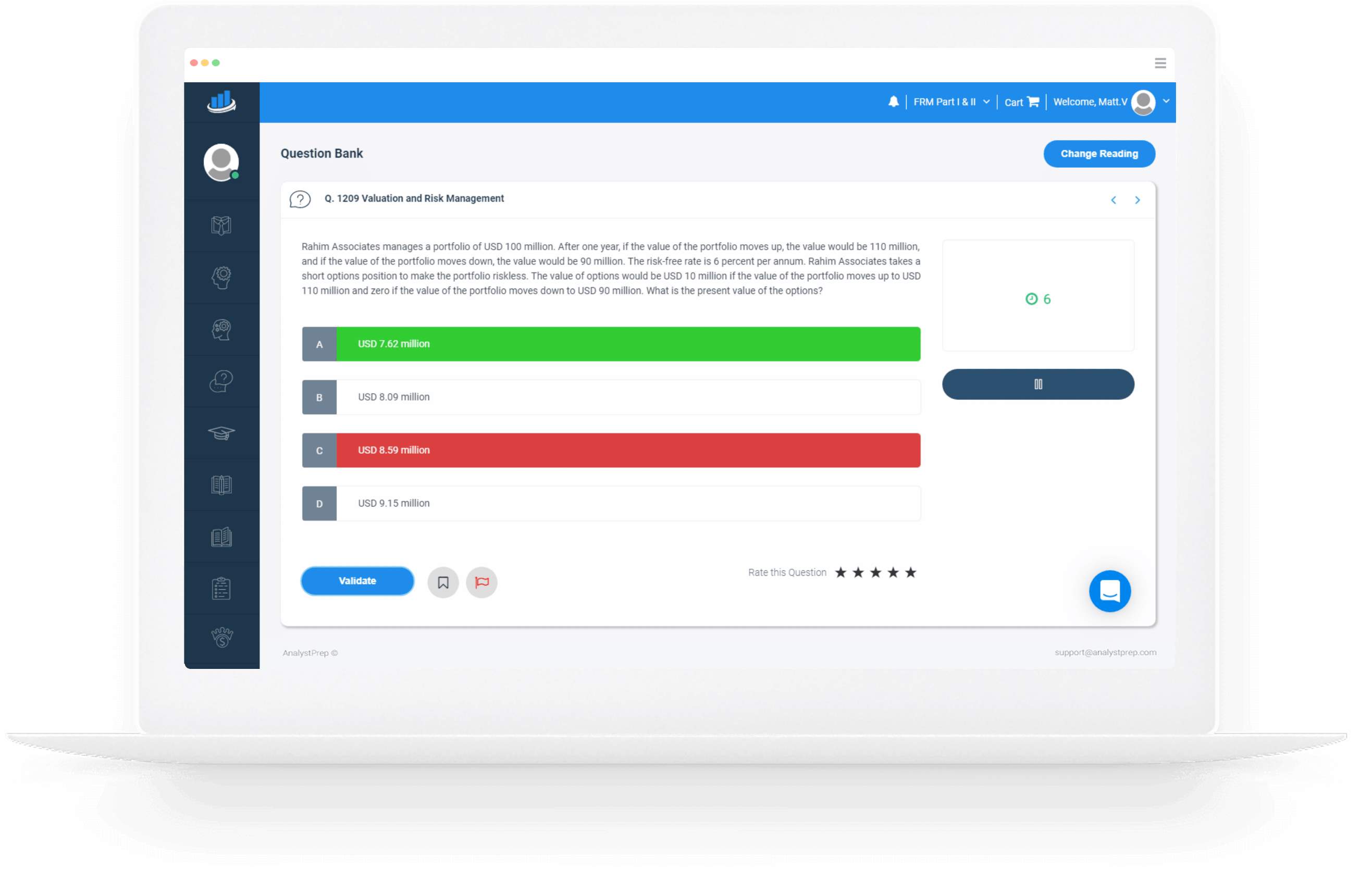

题库、模拟考试、学习笔记和视频课程

用于CFA®,FRM®和SOA®考试的研究材料

由Analystrep提供

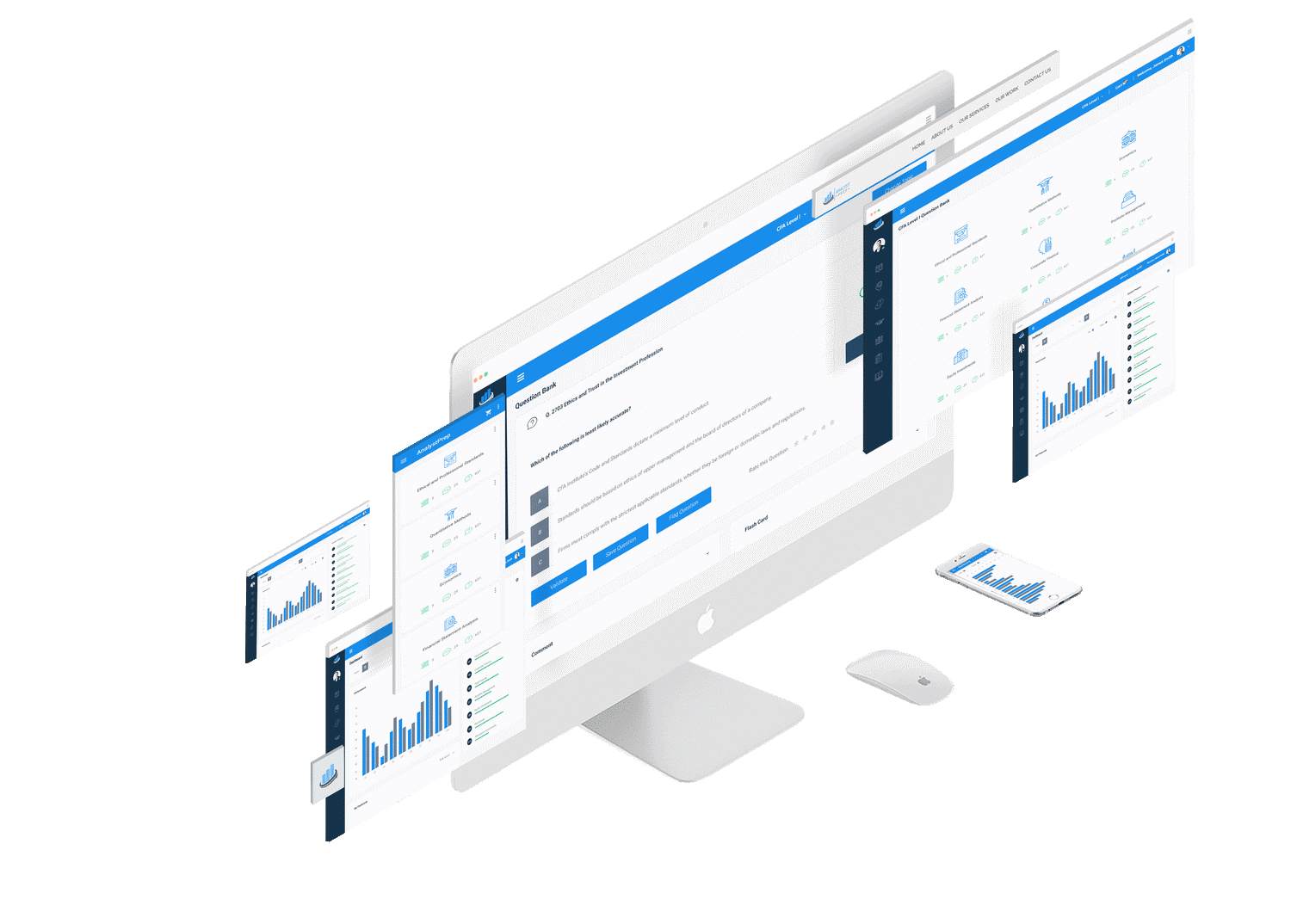

欢迎来到分析秘密

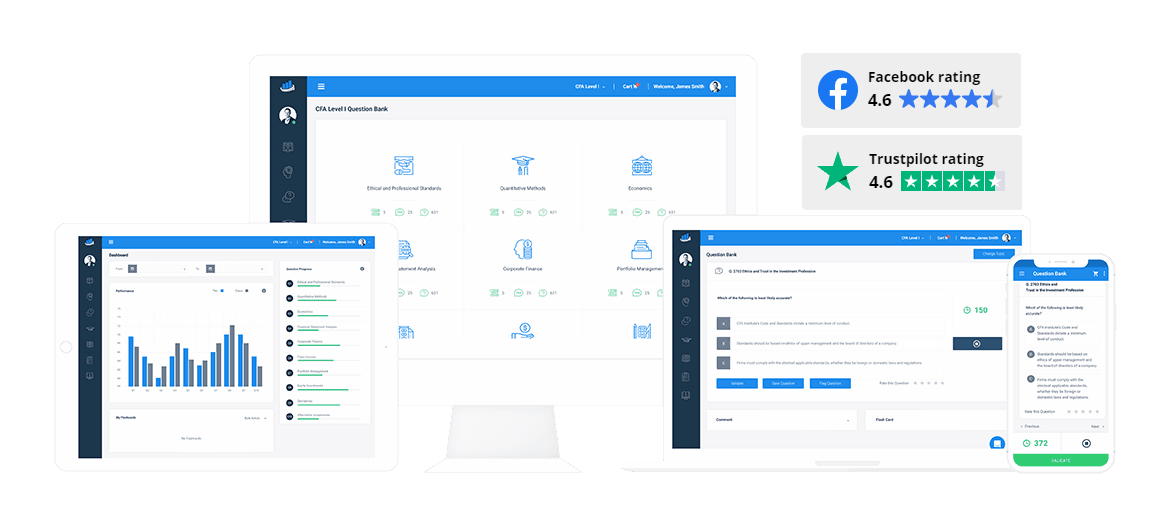

CFA的#1级准备平台®程序与FRM®程序

带上你的学习经验新的高度与分析专家

3.5

百万

我们的用户回答的问题

50

千

满意的客户

#

1.

评分为

评审网站CFA准备平台

分析人员代表终审法院®程序